A Hard Fall After the Pandemic Surge

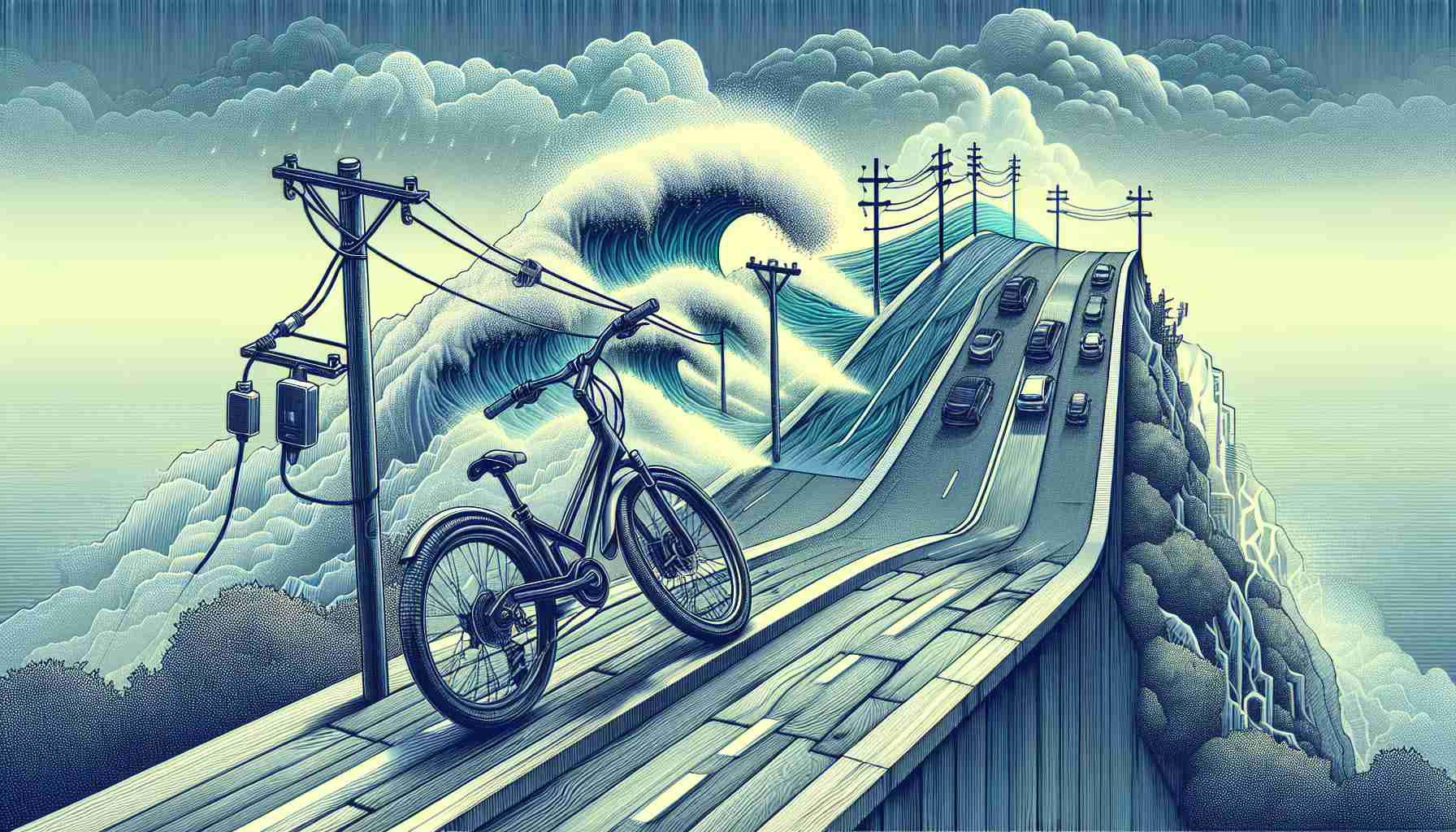

The European bicycle industry, buoyed by an unprecedented boom during the COVID-19 pandemic, now faces significant headwinds. The recent report from Roland Berger unveils the stark reality of overstocked inventories, dwindling demand, and tightened liquidity. While early speculation hoped for market stabilization by 2025, it now appears that recovery may stretch beyond 2026.

Pandemic Boom Turned Bust

The surge of bicycle purchases during 2020 to 2022 has sharply declined in the following years. Manufacturers are left struggling with excess inventory that’s expensive to manage. Companies like industry leader Accell and recently bankrupt Fuell exemplify the challenges in staying viable as the market softens across Europe.

The Weight of Overstock

Stock management has emerged as a crucial issue, with some companies holding over a six-month supply. This inventory excess hampers innovation and investment in new models. Businesses find themselves under financial strain as they resort to price cuts, narrowing their margins and destabilizing their financial foundation.

Restrictive Lending and Cost-Cutting Measures

This situation is exacerbated by the banking sector’s reluctance to extend credit due to increased market risk and volatility, as highlighted by Roland Berger. Consequently, many industry players have frozen hiring and marketing budgets, attempting to streamline operations.

Looking Towards a Gradual Recovery

Despite a gloomy forecast through 2024, a slow market recovery is anticipated by 2026. Electric bicycles are expected to capture a larger market share, particularly in urban areas with supportive governmental policies. However, established brands must evolve to survive, enhancing direct sales channels and brand positioning in face of new market entrants.

Survival Strategies

For sustainability during this challenging period, manufacturers should simplify product lines, a tactic already employed by companies like Cowboy. Embracing flexible supply chains and increased European production can also bolster resilience. Roland Berger underscores the need for altered distribution strategies that leverage direct-to-consumer models to complement traditional retail channels.

The Hidden Impacts of the Bicycle Market Plunge: Community, Economy, and Beyond

Unseen Ripples in the Bicycle Market Decline

The downturn of the European bicycle industry transcends simple economics, touching upon broader social and environmental facets. While industry insiders focus on the financial aspects, such as overstock and market stability, there are deeper effects on communities and economies that warrant attention.

Community Impact and Cycling Culture

The pandemic-induced bicycle boom had an unexpected side effect: a significant cultural shift toward cycling as a primary mode of transport in urban areas. With the market’s decline, the momentum that cycling advocacy groups had harnessed faces potential setbacks. Reduced investment in cycling infrastructure and innovation could hinder the progress seen in cities like Amsterdam and Copenhagen, where cycling is not just popular but a lifestyle.

Controversies and Policy Debates

The slow recovery in the bicycle industry has sparked debates about governmental roles in supporting sustainable transportation. Despite ambitious climate goals, many European governments have cut back subsidies for electric bicycles, inciting criticism from environmentalists. These supporters argue that financial aid is crucial to maintaining cycling’s popularity, especially in urban centers seeking to reduce car dependency.

Bicycles and Economic Dynamics

Beyond individual companies facing economic challenges, entire economies are affected. Regions reliant on bicycle manufacturing and sales, such as parts of the Netherlands and Germany, are experiencing job cuts and reduced economic activity. This has led to broader discussions about diversification and economic resilience in areas dominated by single industries.

Advantages and Disadvantages: A Dual-Edged Sword

The current state holds mixed blessings. On one hand, the overflow of bicycles in the market has led to price reductions, making bicycles more affordable. This could further democratize cycling, making it accessible to a broader section of society. On the other hand, lower prices and reduced margins mean less funding available for innovation, potentially stalling advancements in technology such as more efficient electric bicycles.

Can We Shift Gears?

The pressing question is how the industry and societies can adapt to these challenges. While direct-to-consumer sales models and European production are touted as solutions, these approaches require significant shifts in business models and consumer habits.

How Does This Affect You?

Whether you’re a cyclist, an urban planner, or an environmental advocate, the state of the bicycle industry likely impacts you. Less investment in innovation could mean slower progress toward more sustainable urban environments. Yet, an influx of affordable bicycles could enhance low-income accessibility to reliable transport.

Related Reading

For further insights into global transportation trends and economic impacts, you might explore these domains:

World Economic Forum, Forbes, and BBC.

In conclusion, while the European bicycle industry faces a daunting path ahead, the ongoing changes present opportunities for strategic reinvention and increased accessibility, heralding complex yet potentially positive future developments.