- European startups Altilium and tozero are revolutionizing electric vehicle battery recycling to promote sustainability.

- Altilium’s innovative recycling method at Imperial College has created small batteries that outperform those made from new materials, reducing CO2 emissions by 70% and lowering costs by 20%.

- tozero addresses the carbon-heavy graphite production using a renewable energy-powered hydrometallurgy process to achieve emissions neutrality.

- The startups are leading the way for European policy changes that will require recycled materials in electric vehicle batteries by 2030.

- Altilium and tozero are not only competing with China but are setting new standards in the electric vehicle industry.

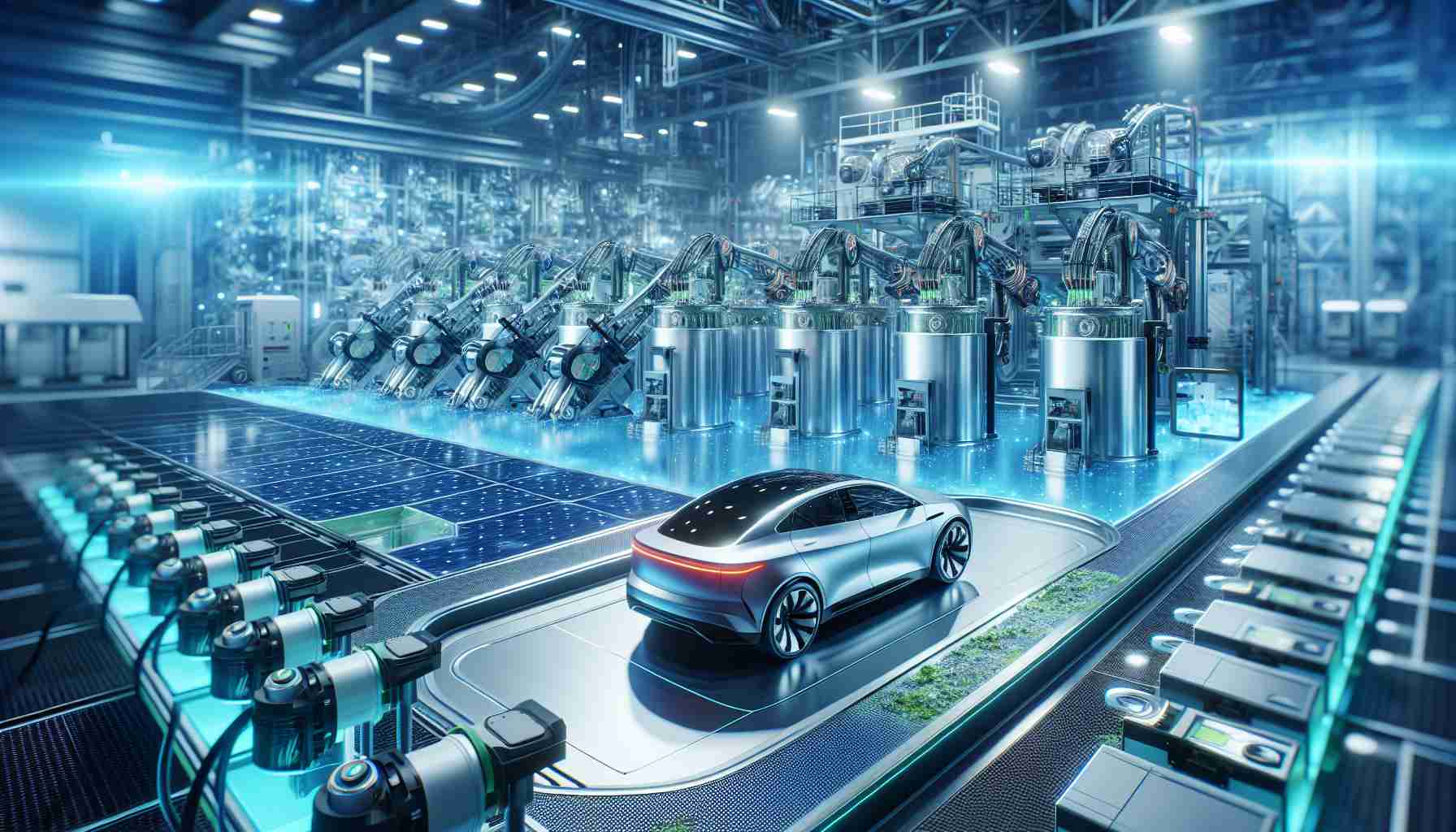

Across Europe, spirited innovators are quietly reshaping the electric vehicle landscape. Against a backdrop of regulatory pressures and global competition, two dynamic startups, Altilium from the UK and Germany’s tozero, are steering the continent towards a greener horizon by rewriting the rules of battery recycling.

Altilium’s discovery at London’s prestigious Imperial College stunned the EV community. By repurposing the cathode active materials—comprising lithium, cobalt, nickel, and manganese—this nimble startup has crafted small batteries that challenge and even outperform those built from virgin components procured from China. Imagine the possibilities: slashing CO2 emissions by a staggering 70% while trimming production costs by 20%. Altilium has transformed what seemed an environmental burden into a lucrative opportunity for automakers wary of recycling risks.

Meanwhile, to the east, Germany’s tozero ventures into equally pivotal territory. The startup tackles one of the most carbon-heavy elements of battery production: graphite. Utilizing a cutting-edge hydrometallurgy technique powered entirely by renewable energy, tozero achieves emissions neutrality. And they aren’t stopping there. Plans are underway for a pilot plant set to yield 2,000 tonnes of recycled graphite annually by 2027, enough to power 50,000 EVs.

These audacious strides align with Europe’s upcoming policy shifts. By August 2030, new mandates will require a percentage of recycled materials in all EV batteries—6% for lithium and nickel, and 16% for cobalt. Altilium and tozero have not just joined the race; they are setting the pace, challenging China’s formidable hold on the industry.

A sustainable future for electric vehicles draws nearer, driven by European ingenuity and an unwavering commitment to environmental stewardship. The message is clear: Europe is ready to rewrite the rules of electric mobility.

Revolutionizing Battery Recycling: Europe’s Bold New Move in the EV Industry

How-To Steps & Life Hacks

1. Understanding Battery Composition: Recognize the key components like lithium, cobalt, nickel, and manganese to better appreciate the recycling processes initiated by startups like Altilium and tozero.

2. Reducing Carbon Footprint: Implement personal eco-friendly practices such as opting for EVs with recycled batteries, thus contributing to a 70% reduction in CO2 emissions as demonstrated by Altilium’s innovations.

3. Supporting Renewable Energy: Advocate for and invest in solutions powered by renewable energy, similar to tozero’s hydrometallurgy method.

Real-World Use Cases

– Automakers: Major automotive brands can strike partnerships with companies like Altilium for access to cost-effective recycled batteries, cutting production costs by 20% while complying with future mandates.

– Urban Development: Cities aiming to transition to electric public transport systems could leverage tozero’s recycled graphite, achieving both efficiency and sustainability goals.

Market Forecasts & Industry Trends

– Policy Impact: By 2030, European regulations demanding set percentages of recycled materials in EV batteries will significantly shape the market, prioritizing local, sustainable practices over traditional sourcing from regions like China.

– Industry Growth: According to industry reports, the global battery recycling market is projected to reach $23.2 billion by 2026, driven by regulations and innovations introduced by startups within Europe.

Reviews & Comparisons

– Altilium vs. Traditional Batteries: Altilium’s recycled batteries reportedly outperform those using virgin materials, suggesting a paradigm shift in both performance and environmental impact.

– Environmental Health: The hydrometallurgy technique used by tozero is more eco-friendly compared to conventional recycling methods, which often rely on more energy-intensive processes.

Controversies & Limitations

– Supply Chain Challenges: There could be logistical hurdles in scaling the collection and processing of used batteries across Europe efficiently.

– Economic Viability: While initial successes are promising, the long-term economic feasibility of scaling these recycling processes on a global scale remains under scrutiny.

Features, Specs & Pricing

– Recycling Efficiency: Altilium’s processes reclaim nearly all essential minerals from used batteries, with a projected 20% cost reduction in manufacturing.

– Production Output: tozero plans to produce 2,000 tonnes of recycled graphite annually by 2027, which reflects its ambitious scaling strategies.

Security & Sustainability

– Resource Security: By relying on local resources, European companies can decrease dependency on foreign imports, reducing vulnerabilities related to geopolitical tensions.

– Environmental Protection: The focus on recycling contributes significantly to reducing the ecological impact of mining and other resource extraction activities.

Insights & Predictions

– Global Leadership: Europe could potentially lead the global EV battery market by inspiring similar recycling initiatives worldwide and setting high standards for sustainability.

– Technological Advancements: Continuous innovations in recycling technologies are expected to further enhance battery performance and cost-efficiency, easing the transition toward a wholly sustainable EV industry.

Actionable Recommendations

– Consumers: Opt for vehicles incorporating recycled battery components from companies like Altilium and tozero to support sustainable innovations.

– Investors: Look into funding ventures focused on battery recycling technologies, as they present significant growth opportunities aligned with regulatory and environmental trends.

For more exploration of this topic and other related advancements, visit major automotive and tech domains like CNBC and The Verge.