Indian EV motorcycle startup Matter has recently secured an impressive funding of Rs 82.6 crore through a private placement offer. The investment was led by Capital 2B, a firm backed by Temasek and InfoEdge, and also included participation from Japan Airlines & TransLink Innovation Fund. In addition, Abhay P Shah via Miracle Carriers & Trading Co and Helena Special Investments Fund I expressed their confidence in Matter by joining the funding round.

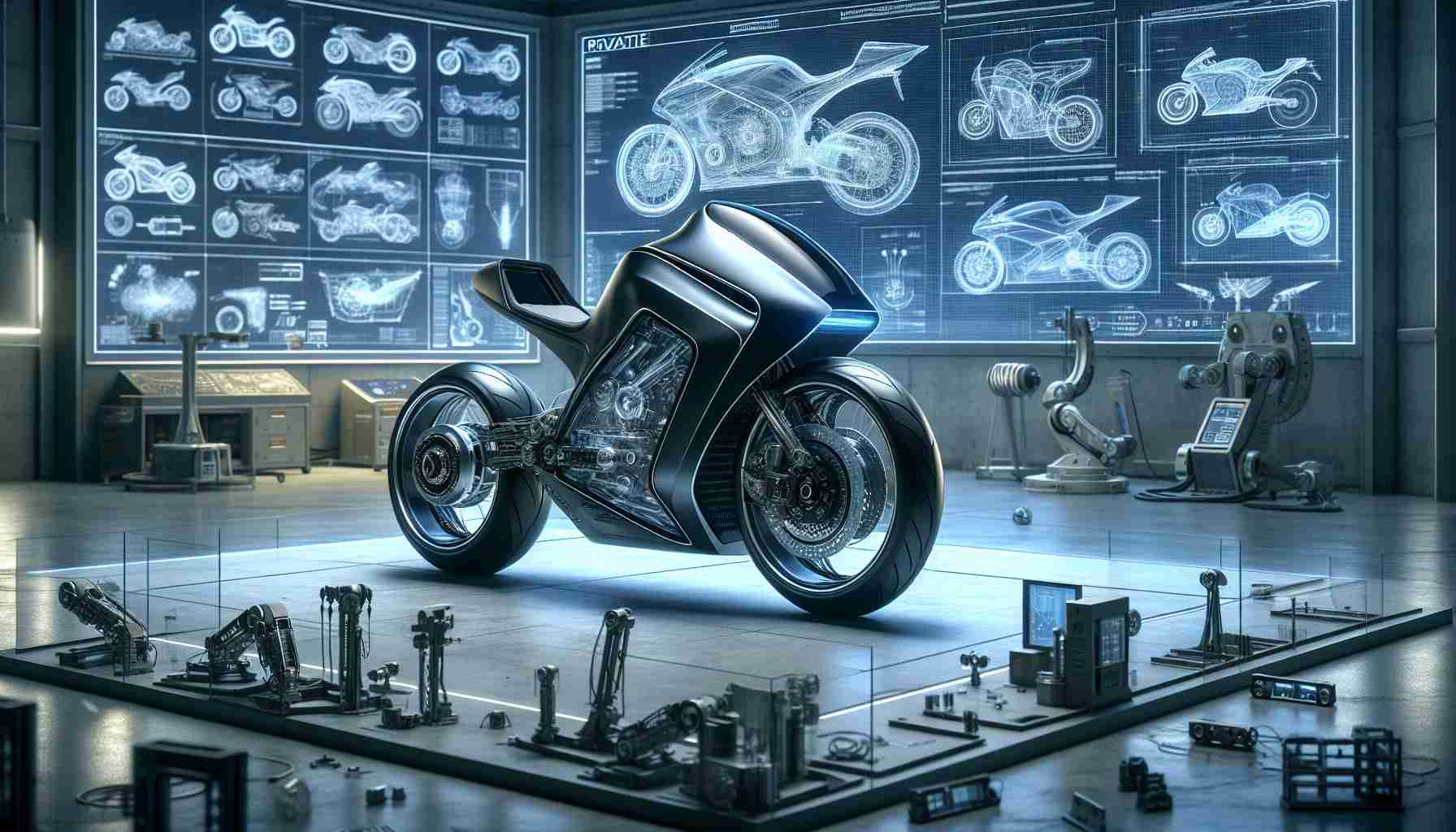

With this substantial financing, Matter is set to further its mission of revolutionizing the electric motorcycle industry. Founded in 2019 by Mohal Lalbhai, Arun Pratap Singh, Kumar Prasad Telikepalli, and Saran Babu, the company specializes in the manufacturing of premium electric motorcycles. Their first two-wheeler EV, named Aera, was launched in March 2023, boasting an active liquid-cooled battery.

However, Matter’s ambitions don’t stop at motorcycles. The company is also devoted to developing lithium-ion batteries for electrical grids and solar energy applications, showcasing a commitment to advancing sustainable energy solutions across various sectors.

The recent funding round follows a successful $10 million raise in 2022 from notable investors such as Capital 2B Fund 1, Climate Angels Fund, Baring Private Equity Partners, and other Indian and overseas high-net-worth individuals. This continued support demonstrates the confidence in Matter’s business model and its potential for exponential growth.

Looking to the future, Matter has set an ambitious target of reaching a turnover of one billion dollars by 2025. This goal aligns with the growing interest in electric motorcycles, as the industry witnesses a shift towards more sustainable transportation options. Competitors such as Ultraviolette, backed by TVS Motor Company, and the impending entry of Ola Electric with its own line of e-motorbikes in 2026, highlight the increasing demand in this sector.

In conclusion, Matter’s successful funding round and its innovative approach to electric mobility solidify its position as a key player in the EV industry. By continually pushing boundaries with their cutting-edge technology and sustainable solutions, Matter aims to reshape the future of transportation.

Matter, an Indian EV motorcycle startup, has recently secured an impressive funding of Rs 82.6 crore through a private placement offer. The investment was led by Capital 2B, a firm backed by Temasek and InfoEdge, and also included participation from Japan Airlines & TransLink Innovation Fund. In addition, Abhay P Shah via Miracle Carriers & Trading Co and Helena Special Investments Fund I expressed their confidence in Matter by joining the funding round.

With this substantial financing, Matter is set to further its mission of revolutionizing the electric motorcycle industry. Founded in 2019, the company specializes in the manufacturing of premium electric motorcycles. Their first two-wheeler EV, named Aera, was launched in March 2023, boasting an active liquid-cooled battery.

However, Matter’s ambitions extend beyond motorcycles. The company is also devoted to developing lithium-ion batteries for electrical grids and solar energy applications, showcasing a commitment to advancing sustainable energy solutions across various sectors.

The recent funding round follows a successful $10 million raise in 2022 from notable investors such as Capital 2B Fund 1, Climate Angels Fund, Baring Private Equity Partners, and other Indian and overseas high-net-worth individuals. This continued support demonstrates the confidence in Matter’s business model and its potential for exponential growth.

Looking to the future, Matter has set an ambitious target of reaching a turnover of one billion dollars by 2025. This goal aligns with the growing interest in electric motorcycles as the industry witnesses a shift towards more sustainable transportation options. Competitors such as Ultraviolette, backed by TVS Motor Company, and the impending entry of Ola Electric with its own line of e-motorbikes in 2026, highlight the increasing demand in this sector.

The electric motorcycle industry is experiencing significant growth globally. The market for electric motorcycles is expected to grow at a CAGR of over 25% between 2021 and 2026. Factors such as government initiatives promoting electric mobility, increasing environmental concerns, and advancements in battery technology are driving the market’s growth.

India, in particular, has been witnessing a surge in demand for electric motorcycles. The government has implemented various incentives and subsidies to encourage the adoption of electric vehicles, including motorcycles. Furthermore, rising fuel prices and the need for sustainable transportation options in congested urban areas are contributing to the growing popularity of electric motorcycles in the Indian market.

However, the industry still faces several challenges. One of the main issues is the limited charging infrastructure for electric motorcycles. Inadequate charging stations and the lack of a standardized charging network pose a significant hurdle for widespread adoption. Efforts are being made to address this challenge with the government’s focus on expanding the charging infrastructure and promoting the establishment of public and private charging stations.

Another critical issue is the cost of electric motorcycles. Despite advancements in technology and economies of scale, electric motorcycles are still relatively expensive compared to their petrol-powered counterparts. However, with increased production and the development of more affordable models, the price gap is expected to narrow in the coming years.

Overall, the Indian electric motorcycle industry holds significant growth potential. With the support of investors and an increasing focus on sustainable transportation solutions, companies like Matter are well-positioned to capitalize on the market opportunities and drive the adoption of electric motorcycles in the country.

For more information, you can visit Capital 2B, InfoEdge, and Japan Airlines.