In a surprising twist on Friday, the tech, energy, and aviation sectors soared, pushing major Wall Street indices into the green. The Dow Jones Industrial Average increased by 0.80%, while the S&P 500 and Nasdaq Composite jumped 1.26% and 1.77%, respectively.

TeraWulf Inc. (NASDAQ:WULF), a standout in the Bitcoin mining arena, caught the eye of many as it climbed 13.92% to close at $6.22 per share. This spike in stock price corresponded with Bitcoin’s remarkable surge past $97,000, tantalizingly close to the $100,000 milestone.

Behind this growth, analysts point to the impact of political signals from the looming Trump presidency. The Trump family’s public backing of cryptocurrency—which they are invested in—has warmed the market to Bitcoin miners, propelling companies like TeraWulf to new heights.

This dramatic rise positions TeraWulf in 10th place among the tech, energy, and aviation leaders that propelled Friday’s rally. Although TeraWulf presents a compelling investment opportunity, there is a belief among market experts that the potential for Artificial Intelligence (AI) stocks is even greater. For those seeking immense returns, some AI stocks are priced attractively with earnings multiples under five.

If you’re interested in diverse investment avenues, you might want to explore our comprehensive report on the most promising AI stocks available today. Stay tuned for more updates in the ever-fluctuating financial world.

Why Bitcoin Mining Stocks and AI Could Be Your Next Big Investment

In the ever-evolving world of finance, certain sectors, like tech, energy, and aviation, have been making waves despite global economic uncertainties. Recent surges in market indices have opened doors to exciting investment opportunities, particularly within Bitcoin mining and Artificial Intelligence (AI) stocks.

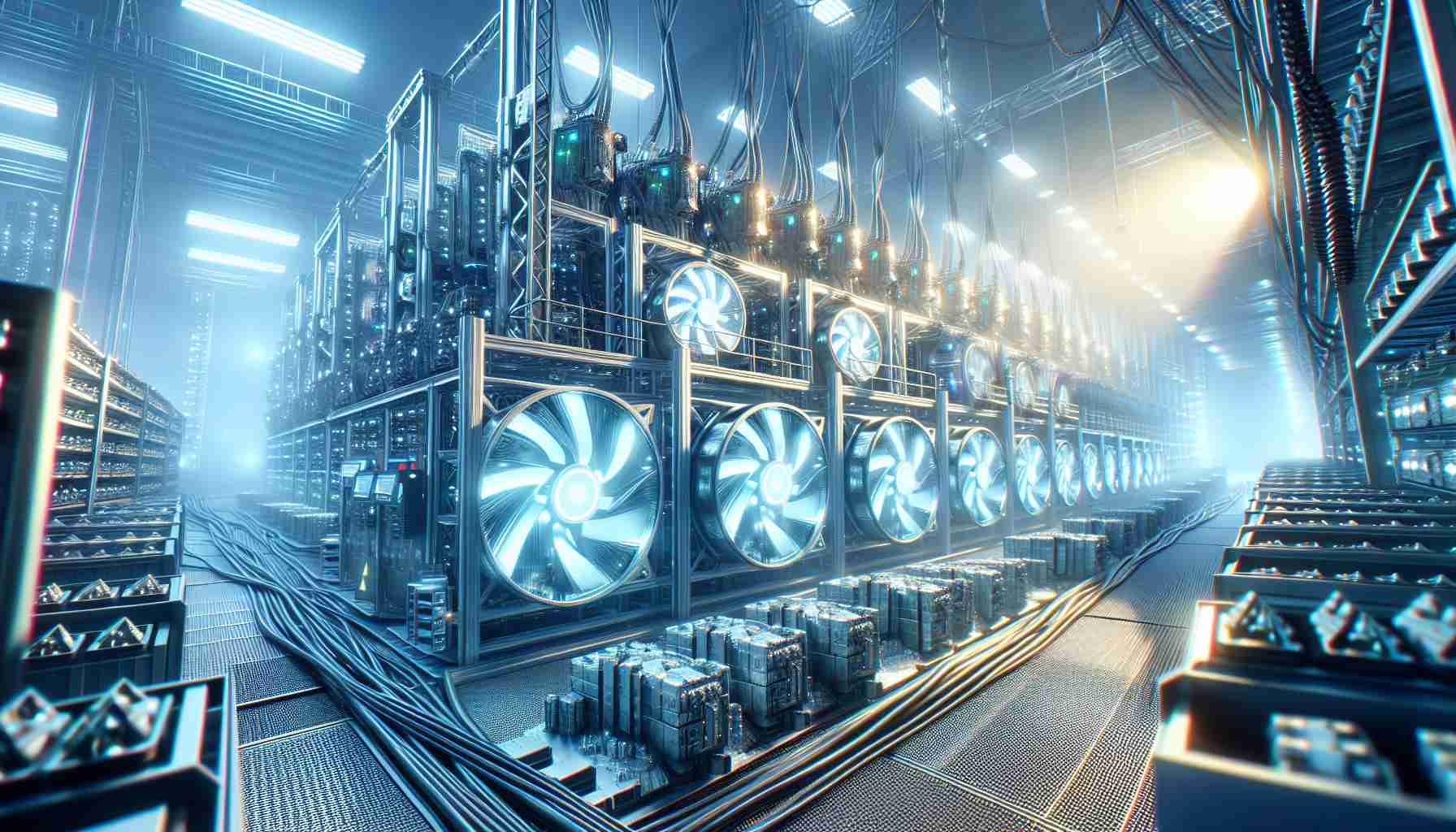

Features and Innovations Driving Bitcoin Mining Stocks

Bitcoin’s Surge Beyond Expectations:

Bitcoin’s impressive climb past $97,000 significantly impacts minor Bitcoin mining firms like TeraWulf Inc., which saw a 13.92% boost in shareholder value, closing at $6.22 per share. Such performance positions Bitcoin miners as a high-risk, high-reward option for investors exhilarated by cryptocurrency’s potential.

Political Influences:

Cryptocurrency markets receive a turbocharged boost from influential endorsements. Notably, the Trump family’s backing signals a noteworthy political endorsement that has drawn market optimism toward crypto mining companies and helped facilitate recent price escalations.

[Learn more about technological innovations and investment options in cryptocurrency.](https://www.terawulf.com)

Insights into the AI Stock Market

AI Stocks: A Promising Frontier:

While Bitcoin mining provides current profit potential, many financial analysts suggest AI stocks may offer even more significant long-term gains. Emerging AI companies are transitioning AI from abstract potential to practical applications, and many stocks are trading at attractive price-to-earnings multiples below five.

Market Predictions and Trends:

AI technology’s integration across industries is expected to drive unparalleled market growth. Predictions indicate substantial improvements in AI capabilities in areas like automation, machine learning, and data processing, positioning these stocks as crucial elements of any forward-thinking investment portfolio.

[Explore the vast potential of AI technologies and stocks.](https://www.openai.com)

Pros and Cons of Investing in Bitcoin Mining vs. AI Stocks

Pros of Bitcoin Mining Stocks:

– Short-term Gains: Beneficial for investors looking to capitalize on current crypto surges.

– Volatility as Opportunity: Ideal for traders leveraging market fluctuations.

Cons of Bitcoin Mining Stocks:

– Market Volatility: Significant price swings pose risks.

– Regulatory Challenges: Potential obstacles due to shifting governmental policies on cryptocurrency.

Pros of AI Stocks:

– Long-term Potential: AI is increasingly fundamental across multiple sectors.

– Wide Array of Applications: Facilitates growth in several industries from healthcare to finance.

Cons of AI Stocks:

– Initial Volatility: Early-stage AI companies may encounter initial instability.

– Unpredictability of Adoption: Timing and scale of AI integration can be uncertain.

Market Analysis and Predictions

The current trends highlight investment potentials within a volatile financial landscape. While Bitcoin’s substantial upward momentum offers exciting immediate prospects, AI stocks could yield gradual but powerful returns over time. As the world adapts to new technological innovations, investors might find the balance between immediate crypto profits and the long-term promise of AI stocks particularly advantageous.

Stay informed on future predictions and investment opportunities with continuous updates from market specialists. Understanding the landscape thoroughly will guide smart investments in this dynamic environment.