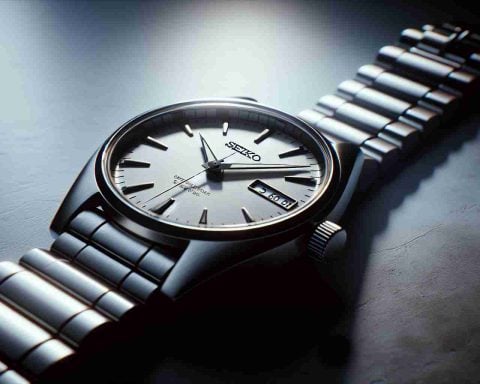

Mark your calendars: Satori Electric is on the move. For those eyeing dividends, there’s an important date approaching—Satori Electric Co., Ltd. (TSE:7420) will trade ex-dividend in just three days.

Understanding the Timeline: The ex-dividend date is critical as it falls one day prior to the record date. To secure your dividend from Satori Electric this cycle, purchases must be completed before November 28th. Shareholders will rejoice when dividends of JP¥40.00 per share are dispatched on February 14th.

The Numbers Game: Total dividends amounted to JP¥86.00 last year, resulting in a healthy 4.6% yield against the current share price of JP¥1884.00. But are these dividends sustainable? Typically, dividends are drawn from earnings, so if outflows exceed income, cuts may occur. Satori Electric has been prudent, distributing 53% of its earnings—common for many firms. Plus, it utilized only 24% of free cash flow, indicating a secure dividend stream.

What the Future Holds: Earnings have surged by 53% annually over the past five years, a promising indicator for dividend growth. Consistently increasing dividends by 16% annually over the past decade shows that this firm is not only stable but flourishing.

Investors should weigh Satori Electric’s robust earning growth, sensible payout ratio, and steady dividend increase as positive signs. While investing, always keep an eye on market risks, but this might just be a stock worth a closer look.

Navigating the Future: How Satori Electric’s Strategies May Power Technological Advancements

As Satori Electric gears up for its upcoming ex-dividend date, questions arise about the broader impact of its financial strategies and business model on technology and society. While financial metrics are critical for investors, examining how Satori Electric might influence future technologies and humanity’s advancement is equally intriguing.

Illuminating Technological Prospects: Satori Electric operates in an industry crucial for the backbone of technological infrastructure. The company’s prudent financial strategy, underscored by a conservative payout ratio and robust earnings growth, allows it to reinvest in research and development, potentially fostering new innovations in electrical components and systems. Such advancements are key to powering everything from smart grids and sustainable energy solutions to cutting-edge consumer electronics.

A fascinating consideration is how Satori Electric’s financial stability positions it to explore partnerships with tech firms and research institutes, potentially accelerating advancements in semiconductor technology and smart circuitry. As societies increasingly prioritize energy efficiency and integration of renewable sources, firms like Satori Electric could be pivotal in providing reliable and sophisticated electrical solutions.

The Controversies of Capital Allocation: Companies face the dilemma of balancing shareholder returns with reinvestment in growth, particularly in technology sectors where innovation is rapid. Some critics argue that high dividends might restrict the capital available for groundbreaking research and development. However, Satori Electric’s balanced approach—using 53% of earnings for dividends while keeping reinvestment on track—illustrates a strategy of nurturing core business while rewarding investors.

Advantages and Disadvantages: A primary advantage of Satori Electric’s model is its strong financial health, which provides a buffer against potential economic downturns. This stability can encourage continued investment in technology and infrastructure. On the downside, even with promising growth, the industry’s cyclical nature could pose risks, impacting innovation funding during economic slowdowns.

Frequently Asked Questions and Insights:

– Could high dividends restrict technological innovation? Not necessarily. While high payouts can sometimes limit reinvestment, Satori Electric’s approach suggests that it’s possible to maintain a balance that supports both shareholder and innovation needs.

– What role might Satori Electric play in smart technology evolution? With solid financials and a focus on electronics, Satori Electric is well-positioned to contribute to new tech developments, such as energy-efficient systems and advanced semiconductor technologies.

For those interested in exploring more about the technologies and influence of companies like Satori Electric, consider visiting IEEE for insights on electrical technologies and their societal impacts.

Ultimately, Satori Electric illustrates how companies can strategically manage finances to propel technological innovation, enabled by a secure dividend foundation. As technology evolves, companies like Satori are poised to be at the forefront, influencing the future landscape of human advancement.