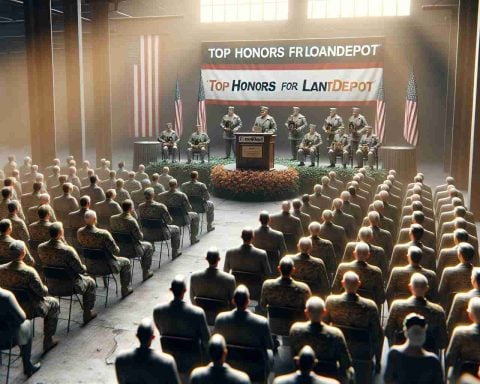

loanDepot (NYSE: LDI) has achieved significant recognition for its dedicated service to military personnel by being named one of 2024’s ‘Best Military Lenders’ by National Mortgage Professional. The company is hailed for its exceptional commitment to providing financial solutions that cater specifically to active military members, veterans, and their families.

The company has strategically enhanced its VA lending program. Former U.S. Army Sergeant David Smith has been appointed as VP of National VA Lending, while Navy Veteran Bryan Bergjans takes on the role of National Director of Military Growth and Strategy. This powerhouse team is expected to drive growth and innovation within the VA lending landscape.

loanDepot offers a robust suite of VA lending options, including programs that accommodate a minimum FICO score of 520 and comprehensive VA renovation loans. Additionally, the company is proactive in educating both lenders and the public about VA loans. They provide a VA Masterclass for originators and organize free online training sessions to boost awareness.

Beyond financial services, loanDepot shows its support for military families through investments in pivotal organizations like the Marine Corps Scholarship Foundation and War Heroes on Water. These efforts underscore their commitment to making a tangible impact within the military community.

loanDepot’s dedication to the military sector sets a high standard in the industry, earning the trust and respect of veterans and their families nationwide. Their recognition as a leading military lender highlights their role as a reliable partner for those who serve.

Revolutionizing Military Lending: Unveiling New Horizons for Financial Solutions

Navigating the Intersection of Military Service and Financial Innovation

The recognition of loanDepot as one of 2024’s ‘Best Military Lenders’ underscores a significant development in the ever-evolving landscape of financial services tailored for military personnel. Yet, beyond the accolades and improvements to its VA lending program, it nudges the industry into a more expansive territory of financial and technological advancements that could reshape how we support those who serve.

Exploring the Human Element in Financial Services

While the emphasis on comprehensive VA financial solutions is commendable, the story magnifies a broader yet often overlooked aspect—the essential role of addressing the emotional and social dynamics that military families face. Service members experience unique financial challenges, from frequent relocations to post-service adjustments, demanding lenders like loanDepot not only facilitate monetary transactions but also consider holistic support systems. Greater integration of community-based resources and mental health support into financial offerings could revolutionize the approach to military lending.

Technological Integration—An Unseen Frontier

Advancements in digital technologies, such as AI and machine learning, present new opportunities in the domain of military-focused financial services. Imagine personalized financial advice generated through AI algorithms that adapt to the life changes of military members, extending specific, actionable insights based on historical data patterns. This could foster more personalized banking experiences, building trust and efficiency in financial management. However, such innovations come with concerns about data privacy and cybersecurity—premier challenges that demand stringent protective measures.

Advantageous Pathways: Shaping the Future of Military Lending

With these technological tools, military lenders can pioneer programs that are highly tailored and responsive to the needs of service members and veterans. These pathways can significantly elevate user experience and satisfaction. The enhanced accessibility to educational resources such as VA Masterclasses ensures that knowledge is disseminated effectively, empowering service members to make informed decisions.

Potential Challenges: Scrutinizing the Other Side

Despite these benefits, there arise important questions about accessibility and equity. Can the integration of sophisticated technologies inadvertently create barriers for those less tech-savvy? How do we ensure these services remain inclusive and equitable, particularly for veterans transitioning into civilian life who might not have immediate access to digital tools?

Military lenders must address these disparities by offering a blend of digital and traditional touchpoints. By doing so, they can provide inclusive financial literacy and support, ensuring no one is left behind.

Conclusion: Pathways to the Future

In this rapidly changing environment, companies like loanDepot are not just financial institutions but also act as catalysts for progressive change. Their efforts to integrate community investments alongside financial services establish a dual commitment to both economic and societal impacts. As we look toward the future, developing technologies combined with nurturing human elements might just be the key to empowering our military communities effectively.

For more information, please visit loanDepot and National Mortgage Professional.